I LOVE getting new reports from the Pew Research Center’s Internet Project. For a data geek like me, this is like getting a great big present in my email!

The primary reason I value this research is because you can BELIEVE it. This is not some outfit surveying their customers or blog readers. This is professionally conducted, statistically-valid research that I feel comfortable using with clients.

The latest report on social media usage among US online adults contains no real surprises. Perhaps more interesting is what is NOT there. Let’s look at it briefly from both sides.

What’s there.

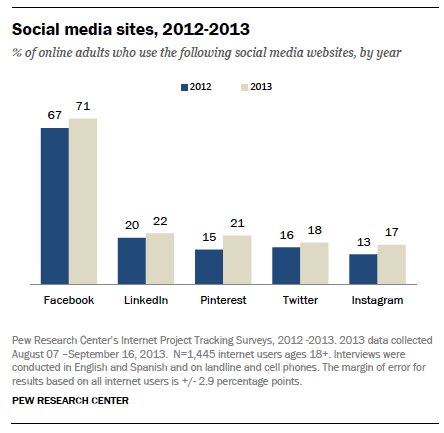

The report says that 73% of online adults now use a social networking site of some kind. Despite recent growth by Pinterest and Instagram, Facebook remains the dominant social networking. A striking new revelation is that a large number of users are now diversifying onto other platforms — 42% of online adults now use multiple social networking sites.

While all of the major sites experienced growth, Facebook’s 71% user rate among online adults represents a significant increase from the 67% of just a year ago.

Facebook also has the broadest appeal and is used across a diverse mix of demographic groups. Other sites have developed their own unique demographic user profiles:

- Women are four times as likely as men to be Pinterest users.

- LinkedIn is especially popular among college graduates and internet users in higher income households.

- Twitter and Instagram have particular appeal to younger adults, urban dwellers, and non-whites.

- There is substantial overlap between Twitter and Instagram user bases.

Facebook and Instagram exhibit especially high levels of user engagement: A majority of users on these sites check in to them on a daily basis.

What’s not there?

Here are a few revelations that are not explicit in the report.

First, where is the decline in Facebook usage we have all been hearing about? This report shows that Facebook usage is GROWING, but people are spending more time in other places too.

It’s also interesting to think about the Facebook-Instagram dynamic. Facebook acquired the non-revenue producing company in early 2013 for $1 billion. That raised some eyebrows at the time but look at the graph above and start to combine some of these numbers in your head and you’ll see why it probably made sense.

In fact it begs the question, will there be further consolidation in the social networking industry? The primary revenue model for a social media company is to 1) collect personal information that can be turned into targeted ads and 2) increase time spent on a site so more ads can be viewed.

As Facebook (and Google and Twitter) all aim for the same attention and the same ad revenue, isn’t some consolidation bound to occur as organic growth becomes more difficult to sustain? We already know Facebook made a run at Twitter and Snapchat. Wouldn’t a Facebook-Pinterest consolidation be a match made in heaven?

Finally, I had to scratch my head and wonder why Google Plus was not included in this survey. I can kind of understand that YouTube (primarily a broadcast channel) may not be in the same category as these other social networks. But where is Google Plus?

I went right to the source and asked Pew Center Director Lee Rainie why this wasn’t included. Here’s his answer: “We’ve asked about Google+ in the past and were worried when we heard respondents being interviewed that they weren’t sure if we were asking about the social networking platform or more broadly about use of any Google product. That was a while ago and we will likely be including Google+ the next time we ask people about social networking platforms.”

It’s interesting that there might be some brand confusion among the general populace around Google Plus. Might suggest that G+ needs to do some advertising to increase awareness?

Any surprises for you on this research?