By Mark W. Schaefer

At SXSW I became aware of a new marketing trend called “market networks.” This new business model of an “enabling economy” seems to coming of age and I thought I would explore the idea.

Market networks represent a different way to do business compared to sites like Air BNB or Uber that simply aggregate demand. In that model, neither the seller nor the customer matter. An Uber driver doesn’t know the customer and the customer doesn’t know the driver. They may never connect again.

But what if the service provider and client DO matter? What if you want to do business with a very specific person?

Jonothan Yoffe, the founder of AnyRoad described how he got the idea for his travel-related market network. He paid $2,000 for a guided trip to hike up Mount Kilimanjaro. The guide he used was experienced and hard-working but only received $5 out of the $2,000 he paid for the trip.

Where did all the rest of that money go?

Marketing, service, insurance … sure. But the fact is, somebody other than the guide was profiting from the trek. It occurred to him that if you could aggregate all the fragmented professional services needed to run a business like this you could simplify the transaction and put more power (and profit) in the hands of small service providers.

Opportunities for these market networks exist wherever there are groups of service professionals supporting an industry vertical. Organizing this way could have a significant impact on how millions of people work and live, and how hundreds of millions buy services.

The key attributes of these companies:

- Combine the main elements of both networks and marketplaces

- Use SaaS workflow software to focus action around longer-term projects and relationships, not just a quick transaction (like Uber)

- Promote the service provider as a differentiated individual, helping to build long-term business benefits

- A market network elevates the person, their reputation, their value.

- Transaction fees are usually lowered and legal contracts are simplified

- Market networks have stronger retention and engagement than marketplaces

The AngelList (start-ups), Houzz (decorating), LiquidSpace (office space), and StyleSeat (salon services) are pioneering examples of successful market networks. Here are a few stories I heard at SXSW about how these market networks are operating.

StyleSeat

StyleSeat is a beauty start-up in Silicon Valley. In the salon business, much of the profit will drain away from a hair stylist to pay fees, rent on a shared space, marketing, advertising, etc. By aggregating these services to help individual stylists, StyleSeat can direct more customers and profits their way.

Already 400,000 stylists have signed up and 10 million clients use the service every month. The start-up has succeeded entirely by word-of-mouth success.

AnyRoad

As I mentioned, AnyRoad aggregates services for small businesses in the tourism industry. So many small business owners lose out because they don’t know how to efficiently do marketing, SEO, customer service, etc. Creating a market network to aggregate these services greatly simplifies their workflow, and they can run their business from a smartphone app provided by AnyRoad.

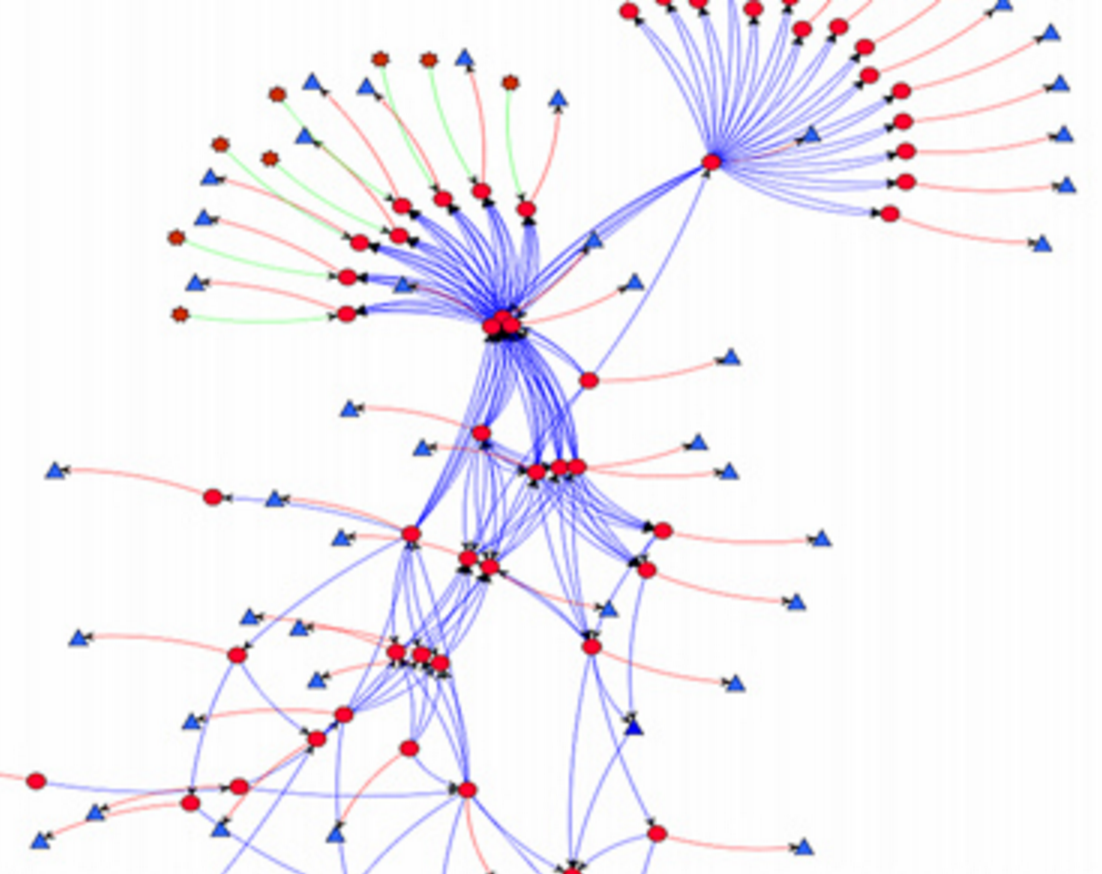

AnyRoad is experiencing tremendous growth because they found that the “nodes” in their network started expanding the network as the tour guides connected to the concierges and agencies that generate their business.

On average, their customers are growing their business by 30 percent in the first month through access to new customers and markets.

Liquidspace

Liquidspace is a market network for working space. The founder, Mark Gilbreath, discovered that leasing office space was generally an inflexible and complicated business.

The traditional real estate model does not work for most new businesses – a start-up might need space for days, then a month, and eventually a year or more to adjust to the dynamics in their business.

LiquidSpace rapidly signed up 50,000 companies in 800 cities and 5,000 venues as a marketplace for office space. One particular creative solution is to connect to hotels to lease unused rooms and meeting areas for temporary business space.

The company also offers a service to alert businesses when property in a certain area becomes available to most effectively connect supply and demand. You can also rent space in a very efficient way by implementing pre-negotiated, standard legal contracts.

Who loses

With any disruptive idea, not every company will benefit from this trend. Here are the types of companies that could lose:

- Those who collect fees as an intermediary

- Capitalists investing in brick and mortar services

- Marketplaces that are not providing value to the vendors, who are simply aggregating demand.

These market network business have the potential to disrupt traditional markets by doing something in an entirely new way. They are unburdened by the traditional confines of an industry and provide a value that is different from, and maybe even better than, the standard way. This new way might not be cheaper, but it is more flexible and immediate – for the user and the providers.

What are your thoughts?

This post was originally written as part of the Dell Insight Partners program, which provides news and analysis about the evolving world of tech. For more on these topics, visit Dell’s thought leadership site dell.com/futureready. Dell sponsored this article, but the opinions are my own and don’t necessarily represent Dell’s positions or strategies.

Illustration courtesy Flickr CC and Simon Cockell