By Keith Reynold Jennings, {grow} Contributing Columnist

My family loves boogie boarding, bodysurfing, and surfing.

Our biggest challenge, given we only get to the ocean every other year or so, is that it takes some practice timing the waves. If we’re too far forward or back in the break, we miss the ride. Or wipe out!

In a 2015 TED Talk, serial entrepreneur Bill Gross revealed that the top reason startups succeed isn’t due to some big idea, elite team, business model, or funding. The single biggest factor in a startup’s success is timing.

A key part of a marketer’s job is mastering timing. The right product at the right price with the right distribution and promotion strategy can still fail if the timing is wrong. If we are too early or late, we’ll miss the ride. Or wipe out!

In this article, I introduce a model that has helped me anticipate trends up to 20 years away. My hope is that it helps you prepare for what’s coming.

- First, I’ll introduce you to the model, which is called spending wave theory.

- Then we’ll look at some of today’s trends through the lens of this model.

- Finally, we’ll look twenty years ahead to what is likely coming.

Introduction to Spending Wave Theory

Back in the early 1990s, economist and academic, Harry S. Dent, published his first national bestseller, The Great Boom Ahead. His thesis, which I first encountered in that book, has become known as spending wave theory (also known as age wave theory).

Spending wave theory essentially states that people do predictable things as they age. Therefore, consumer spending by age is the best predictor of an economy’s macro trends and future performance.

Let’s look at the typical spending cycle in a middle-class economy:

- 20s: Young adults earn and spend relatively little, so they have little impact on the greater economy.

- 30s: Earnings and spending increase as people marry/partner, buy first homes and have children.

- 40s: Spending further increases as people raise children and trade-up to larger homes.

- 50s: Spending peaks, then begins to decline as children leave home for college.

The economic impact of this lifetime spending cycle is driven by the size of each generation, as measured by births and immigration. Each generational wave has its unique size and force as it builds and breaks across its forty-year work-life cycle.

According to Dent, this engine — (total live births + immigration) x lifetime spending cycle — allows us to anticipate trends decades in advance.

Births and Immigration Drive Economies and Trends

Let’s look at the Baby Boom generation in the U.S. to better understand spending wave theory.

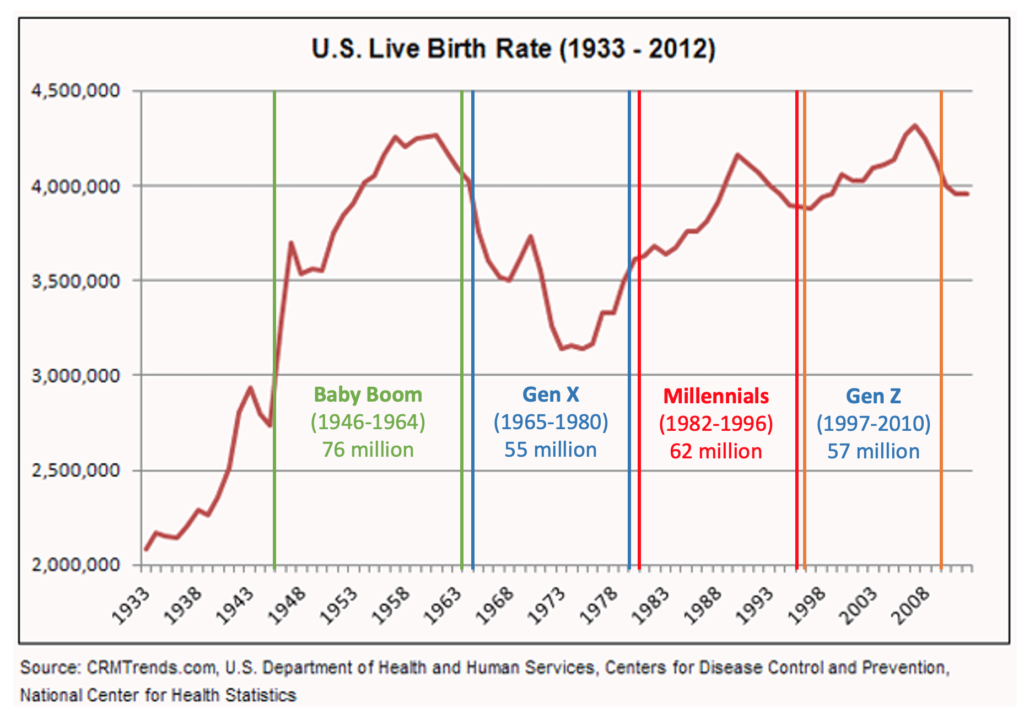

Between 1946 and 1964, 76 million births occurred, making Baby Boomers the largest generation in U.S. history.

Now, let’s look at Baby Boomer’s life cycle:

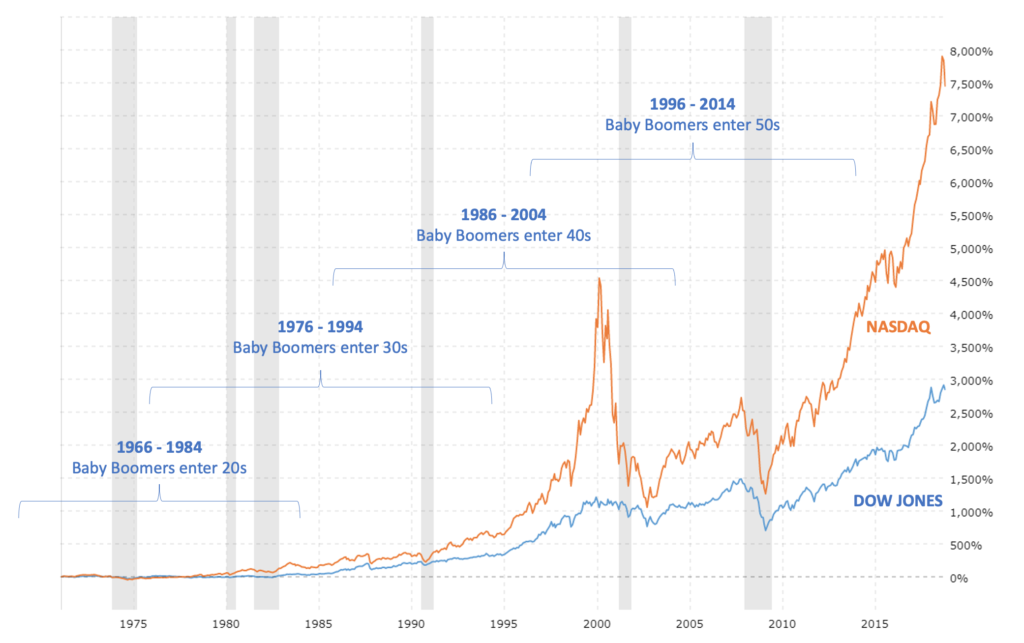

- They entered their 20s between 1966 and 1984.

- They increased spending and consumption in their 30s between 1976 and 1994.

- They hit peak spending in their 40s between 1986 and 2004.

In addition to this generation’s massive size, the U.S. experienced a surge in immigration, both legal and illegal. This created an additional boom, as even more consumers entered the U.S. markets.

Now, let’s look at the Dow Jones and NASDAQ performances as this massive population aged:

Dent’s premise is that the economic boom that began in the 1980s and ran until 2000 was the result of this large demographic of Boomers and immigrants moving through their lifetime spending wave.

Trends such as the proliferation of personal computers, mobile phones, 24-hour news, and video games were the result of the Baby Boom generation “hiring” new technologies to get jobs done in their lives and the lives of their children.

So, what happens when we apply this life-cycle spending to the generations that followed the Baby Boom?

Life-Cycle Spending Drives Today’s Trends

Let’s look at the trends Mark Schaefer recently noted in his post titled, A fast and innovative method of strategy development:

- There is a severe housing crisis.

- The pandemic has redefined how and where we work.

- The pandemic reawakened appreciation of the outdoors and nature.

- The top issue for many young people is the environment.

- The top lifestyle aspiration of Millennials and Gen Z is travel and outdoor adventure.

Other trends I’ve encountered recently:

- Millennials are relocating to the suburbs.

- Gen X women are starting businesses.

- Healthcare consumption among Boomers is, well, booming.

Are these trends a result of the global pandemic? Not likely. These appear to be trends driven by the life cycle season each generation is in.

Could we have anticipated these trends as far back as two decades ago? Probably. How?

- Millennials, the second-largest generation in U.S. history, have entered their 30s.

- The 30s are when people’s earnings and spending increase.

- And the 30s are when people’s family size increases, bigger homes are needed, and parents start to care about school districts, after-school activities, and their kids’ futures.

Given the season they are in their life cycle, Millennials are moving to the suburbs. However, there aren’t enough available houses to accommodate this huge migration of people. Hence a housing shortage.

Gen Z is entering the workforce. They can’t afford a house yet. So, they need apartments.

Millennials want to keep progressing in their jobs, but they don’t want to return to the long commutes and unnecessary business travel required before the pandemic. And given that they currently make up the largest percentage of the workforce, employers are having to reconsider and redefine workplaces and workspaces to remain competitive.

On this topic of remote work, I’m part of a team studying Gen Z attitudes on the workplace. In a recent focus group, we were surprised to learn that the Gen Zers we spoke with want to be in the office. After missing out on key life events, and being separated from friends during the pandemic, they appear to be starving for work environments where they can be around people.

And both Millennials and Gen Z grew up in the era of climate change, so it makes sense that the environment and enjoyment of the outdoors are highly valued.

2041: Looking 20 Years Ahead …

Immigration to the U.S. has significantly decreased due to a combination of the former president’s policies and the pandemic. Birth rates have significantly decreased, as well. These converging trends will have significant future impacts on the U.S. and world.

With Baby Boomers between 57 and 75 years of age, their impact on the economy is waning, with the exception of healthcare consumption, which is growing rapidly.

Starting in 2015 and continuing to 2030, Gen X will peak and begin its decline in spending. However, as a smaller generation than Boomers, the U.S. economy will experience slower growth than we saw in the past.

Millennials will enter their 40s between 2022 and 2036. And their spending will peak between 2032 and 2046.

Dent believes that, despite the Millennial generation being the second-largest in U.S. history, that generation is spread out over more years than Boomers. Therefore, its macro-level impact on economic growth won’t be as profound as we saw with the Baby Boom generation.

On top of this, Gen Z (i.e., those born between 1997 and 2010), are a much smaller generation than the Millennial generation. Therefore, some of the economic trends we are seeing with Gen X will likely parallel what we’ll experience as the Gen Z wave moves through its life cycle.

Dent wrote, “We need to consider hard questions, such as what happens when Japan, most of the countries in Europe, the North American countries, and even China face shrinking workforces and reduced population growth. And what happens when more people retire than are entering the workforce?”

I encourage you to use spending wave theory to ask yourself questions about the next 20 years:

- Are we facing a future housing surplus as Boomers pass and the much smaller Gen X population can’t match the supply? If so, what year might it hit? How will that affect people’s plans to retire and downsize?

- Will we see increases salaries, compensation, and benefits as institutions and businesses scramble to recruit from a declining workforce pool? What impact will this have on those living below the poverty line?

- As Millennials get sucked into the mid-life overwhelm of high-demand jobs, teenagers, and aging parents with complex nest eggs, how will this impact mental health care, financial services, travel, and tourism, etc.?

Spending Wave Theory Where You Live

Throughout this article, I have focused on the United States. As an American, it’s what I best know and understand. But this model can be applied to any country, region, or city.

I’ve simply used the U.S. as an illustration to help you learn how this model works, and how you can apply it to your location and situation.

The key is to look at your region’s current population numbers, immigration and relocation statistics, and live birth totals through the lens of a forty-year lifetime spending cycle.

With this model, you can anticipate what the next twenty years will likely look like for you, your family, career, and community.

Keith Reynold Jennings serves as vice president of community impact for Jackson Healthcare. He writes and speaks at the intersection of values, impact, and identity. Connect with Keith via LinkedIn and his monthly newsletter.

Keith Reynold Jennings serves as vice president of community impact for Jackson Healthcare. He writes and speaks at the intersection of values, impact, and identity. Connect with Keith via LinkedIn and his monthly newsletter.

Illustration courtesy Pexels.com